In excess of modern several years, there has been no greater option for buyers than technological innovation.

The FAANG shares by yourself have attained more than $one trillion in market place capitalization because 2014 – and these shares, together with other tech movers and shakers, have served propel indices to consistent new highs.

Rising Competitors

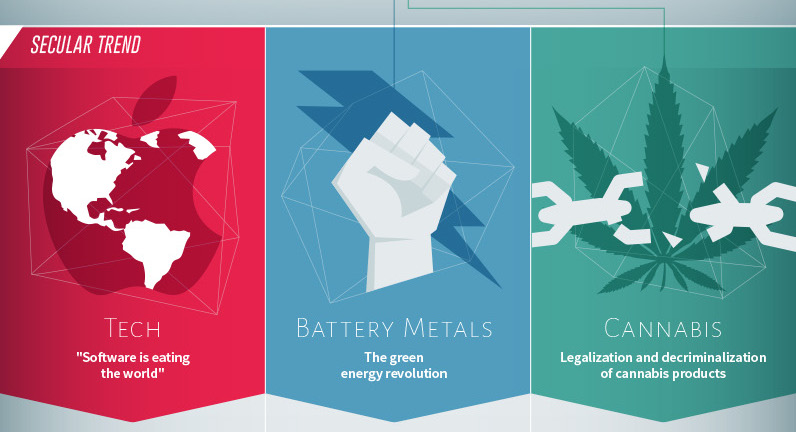

When tech demonstrates no indications of allowing up on its dominance more than marketplaces, buyers really should know about two other multi-billion greenback sectors nipping at its heels. In today’s infographic, completed in conjunction with SmallCapPower, we have highlighted the macro investment decision scenarios at the rear of tech as nicely as these other large-progress locations: battery metals and hashish.

Secular Traits

Like technological innovation, the battery metals and hashish sectors have upside connected to secular traits that are transforming our earth.

Know-how: “Software is consuming the world”

Battery Metals: The eco-friendly strength revolution

Hashish: Legalization and decriminalization of hashish items

As a final result, all of these sectors are poised to carry on increasing at quick premiums:

| Tech | Batteries | Lawful Hashish | |

|---|---|---|---|

| Marketplace sizing (2016) | $880B | $57.0B | $six.7B |

| Marketplace sizing (2021e) | $one.03T | $82.9B | $20.4B |

| Enhance (%) | 17% | 45% | 204% |

It is worthy of mentioning that previously mentioned projections are primarily based on the over-all IT sector, the rechargeable batteries market place, and the authorized hashish market place.

More, it is also significant to acknowledge that personal subsectors in tech are rising considerably quicker than the over-all market place as a full, this kind of as the blockchain, IoT, cybersecurity, SaaS, AI, and VR/AR.

Sustainable Advancement Motorists?

When there is no lack of buzz all around tech, battery metals, or hashish, it is also obvious that all of these marketplaces will only increase in relevance more than time.

In technological innovation, for illustration, the slower-shifting verticals like health care, authorities, finance, and schooling are only beginning to get disrupted. The blockchain is in its early times and will contact several elements of lifetime, and AI by yourself is anticipated to have a $15.seven trillion effect by 2030.

In the meantime, the eco-friendly revolution is driving the long term relevance of battery metals like lithium, cobalt, nickel, and graphite. As EV penetration grows, so does lithium-ion battery use – and these metals are all required to make them perform.

Eventually, the trajectory of legalized hashish appears to be challenging to quit. In many states, hashish is presently readily available for leisure use – and in lately-legalized destinations like Canada and California, the leisure stores will open up up extremely quickly. Nonetheless, the hashish sector is nonetheless in its infancy, and several thousands and thousands of folks are nonetheless anticipated to acquire obtain however. This, like the other two industries, generates a quickly-rising option for equally organization and buyers.