Unlocking the Electric power of Gals in Investing

The economic companies market is going through a remarkable change.

The following technology of buyers will be youthful and significantly far more assorted, with girls using an more and more notable part in developing and rising loved ones and individual prosperity.

Today’s infographic arrives to us from New York Life Investments, and it showcases how this new paradigm will condition the long run of solutions and companies on provide in the market, as properly as how prosperity administrators can cater to these shifting desires.

Rising Financial May possibly

Gals are underrepresented in the investing planet, but this is shifting rapidly. Whilst different cultural and societal causes are contributors to this, there is also a far more uncomplicated driver: increasing financial may.

- Gals-managed prosperity in the U.S. will boost from $14 trillion to $22 trillion involving 2015-2020

- Gals regulate 51% of all individual prosperity in the United States right now

- Gals are established to inherit $28.seven trillion in intergenerational prosperity about the following 40 several years

Gals are starting to be far more essential motorists of revenue and prosperity for their households, as properly:

- Gals are now the principal breadwinners in 40% of U.S. homes – a 4x boost from 1960.

- Gals personal 30% of all personal firms in the U.S.

- Gals now maintain the greater part of administration, expert, and relevant positions (52%)

Lastly, girls now make up the greater part of recipients of Associate’s levels (61%), Bachelor’s levels (57%), Master’s levels (60%), and Doctoral levels (52%) in the United States.

The Prosperity Administration Hole

As girls boost increase their degree of financial affect to new stages, how will they control this prosperity?

Curiously, reports exhibit that girls feel about funds and prosperity otherwise than guys – and otherwise from precedents previously established in the economic companies market:

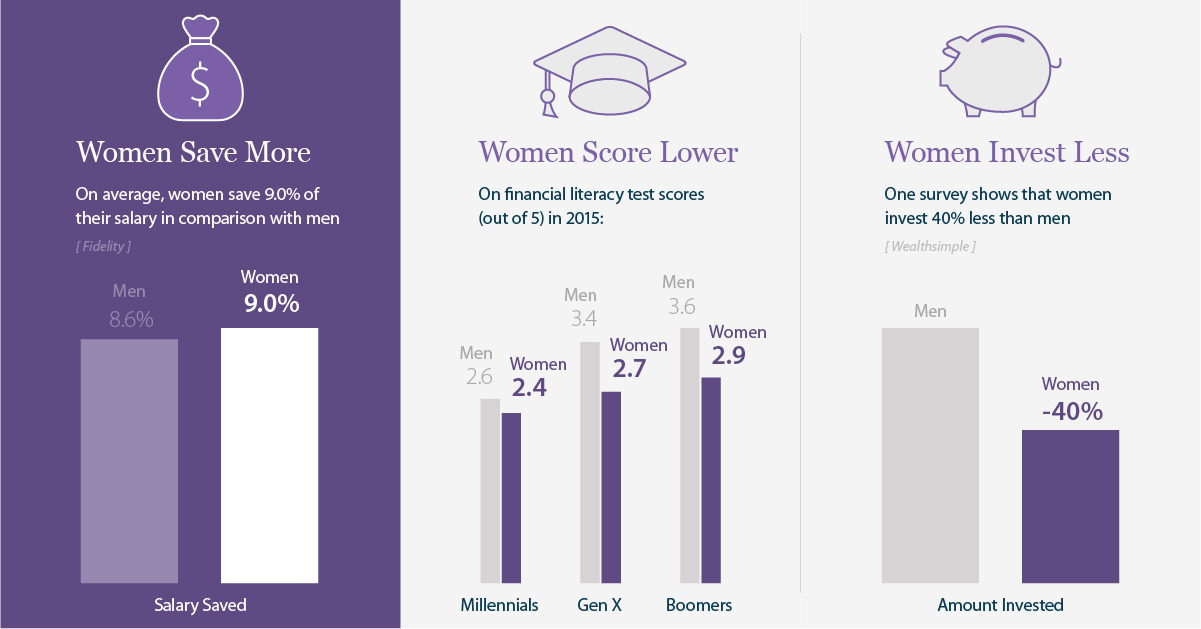

| The Fantastic Information | The Poor Information |

|---|---|

| Gals are greater savers, conserving nine.% of their wage in comparison to guys (eight.six% of wage) | Gals regularly are likely to rating decrease on economic literacy checks |

| Some analysis factors to girls making greater returns (+.four%) off of investments | Some analysis factors to girls investing up to 40% much less than guys |

Modifying Issues

Facts from a modern study by New York Existence Investments sheds mild on why girls may possibly be underserved by the economic companies market.

Factors why girls change economic advisors:

- 33% lousy effectiveness

- 29% absence of individual relationship

- 27% lousy client companies

In other text, girls really don’t change financial commitment advisors just since of lousy effectiveness – there are other, far more intricate elements associated. Component of this is very likely since 62% of girls say they have distinctive financial commitment desires and troubles:

Perceptions of girls and investing:

- Monetary pros take care of girls otherwise – 40%

- Gals really feel patronized by economic advisors – 36%

- Monetary advisors are much less very likely to pay attention to investing tips from a girl – 30%

- Monetary advisors force girls out of economic discussions – 28%

- Gals have much less entry to economic training – 26%

- Monetary pros discover it challenging to relate to girls – 26%

- Monetary advising is a man’s planet – 24%

A Further Dive

It is important for advisors to fully grasp that girls are not one particular huge, homogeneous team.

In reality, analysis displays that there are 4 distinctive segments of girls that just about every strategy investing otherwise – and they all have distinct sets of desires.